The Republic of South Sudan

South Sudan Revenue Authority

Introducing eTax

The convenient way for taxpayers to access the Republic of South Sudan’s South Sudan Revenue Authority services online

The convenient way for taxpayers to access the Republic of South Sudan’s South Sudan Revenue Authority services online

All taxpayers, Citizens, foreigners, businesses, and NGOs, can now apply for a Taxpayer Identification Number (TIN) on eTax online.

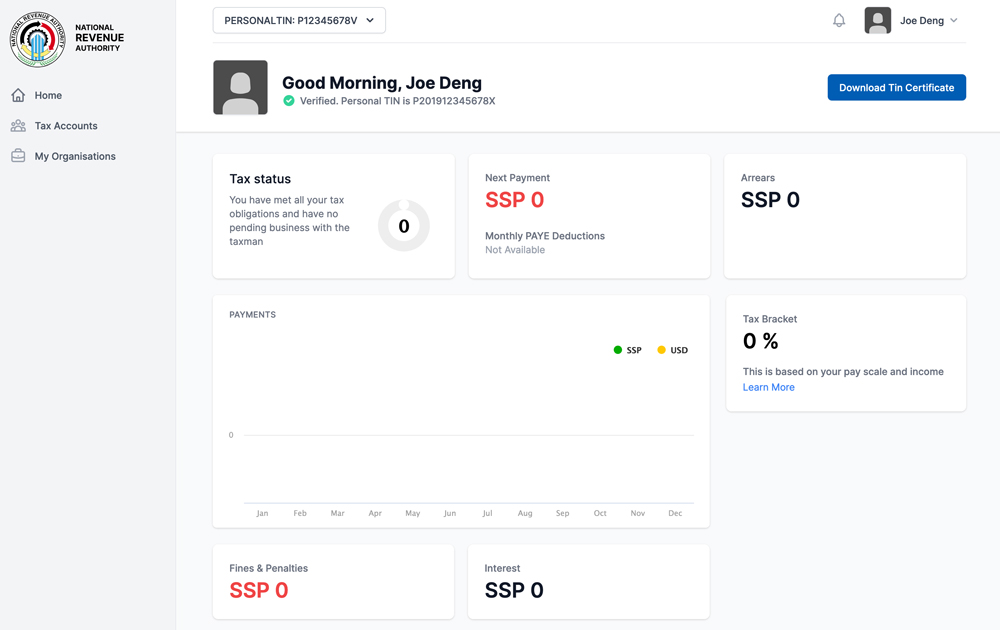

What is eTax? Electronic tax (eTax), is a digital platform developed by the NRA to enable taxpayers access services online.

What is a TIN? A Tax Identification Number (TIN) Is a unique number issued by the NRA to every taxpayer for tax related matters.

For Citizens

TIN registration is available to all South Sudanese Nationals

The Process

Step 1

Step 2

Step 3

Requirements

For Foreigners

TIN registration is available to foreigners who have a source of income in South Sudan.

The Process

Step 1

Step 2

Step 3

Step 4

Requirements

For Businesses

All legally registered businesses, companies or organizations operating in South Sudan require a TIN

The Process

Step 1

Step 2

Step 3

Step 4

Requirements

For NGOs & Non-profit Organizations

Any Non-profit or Non-governmental organization registered with the Ministry of Humanitarian Services can apply for a TIN.

The Process

Step 1

Step 2

Step 4

Step 3

Requirements

Are you experiencing an issue on eTax? We are here to help. Call any of the numbers below or email for immediate assistance.

+211 918806493 +211 912388318 +211 919382390 +211 917803637 +211 921058043

support@nra.gov.ss